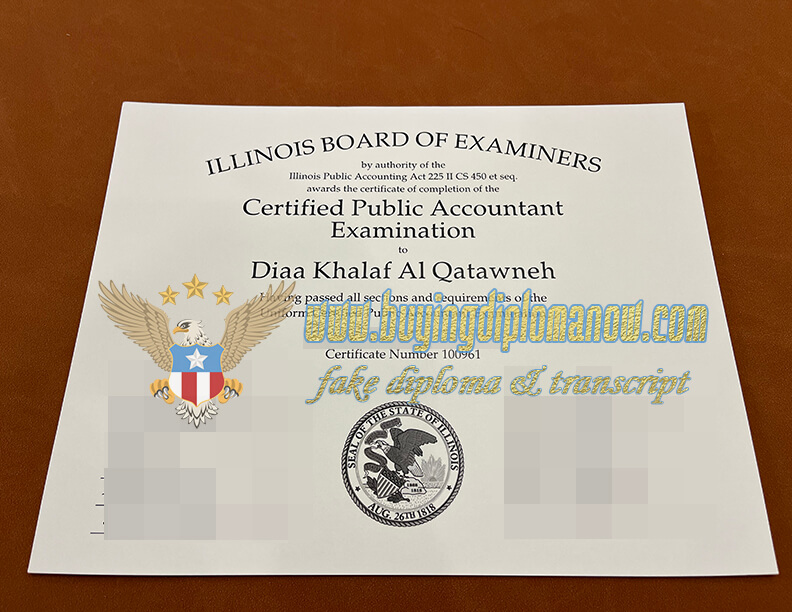

How to Buy Fake Illinois CPA Certificate in the USA? Buy IDFPR Diploma and Transcripts in the USA. How long does it take to buy Illinois CPA diploma online? Buy fake #Illinois CPA certificates in the US. Copy #IDFPR Diploma. Illinois CPA Diploma in USA. Can I Get a Fake Illinois CPA Certificate to Work Online? An Illinois CPA (CPA) is an individual who is licensed as a CPA in the state of Illinois. A CPA is a well-respected accounting professional who meets specific educational, examination and experience requirements and demonstrates competence in accounting and related fields. A CPA is an accounting professional who meets specific education, examination, and experience requirements to earn the CPA designation. Each state in the United States has its own board of accountancy responsible for the licensing and regulation of CPAs.

How to Get Illinois CPA Certificate

1. Education: Completion of a bachelor’s degree or higher from an accredited college or university that includes a specified number of accounting and business-related courses. Specific requirements may vary, but generally, it involves completing a minimum of credits in accounting and business subjects. Buy a fake University of Kentucky diploma online.

2. CPA uniform examination: pass the CPA uniform examination, which is divided into four parts: audit and assurance (AUD), business environment and concepts (BEC), financial accounting and reporting (FAR), and regulations (REG). The exam is administered by the National Association of State Boards of Accountancy (NASBA).

3. Experience: Gain relevant professional experience in accounting or a related field. In Illinois, the experience requirement usually involves working under the supervision of a licensed CPA for a period of time, usually one or two years.

4. Ethics Exam: Complete the Ethics Exam covering Illinois State Accounting Law and the Illinois Board of Examiners Rules of Professional Conduct.

5. Licensure Application: Submit a CPA license application to the Illinois Department of Financial and Professional Regulation (IDFPR). The application process may include providing documentation of education, test scores, experience and completion of ethics courses.

Once an individual meets all requirements and their application is approved, they will receive a CPA license from the IDFPR and be authorized to practice as a CPA in the state of Illinois. Illinois CPAs can provide a wide range of professional accounting services, including auditing, tax planning and preparation, financial analysis, consulting and more.